Interior BC Real Estate Market Shows Sustained Growth in March 2025

The Interior British Columbia real estate market maintained its upward momentum in March 2025, with notable year-over-year increases in both sales and dollar volume. While trends varied slightly across regions and property types, the overall outlook remains positive as we head into the spring market.

Association-Wide Performance

The Association of Interior Realtors reported 1,143 residential sales in March 2025, marking an 11.9% increase compared to March 2024. The total dollar volume reached $767.1 million, up 15.9% year-over-year, underscoring continued price appreciation across the region.

Regional Performance Breakdown

South Okanagan Sees Sharp Rebound

The South Okanagan experienced a 25.2% increase in sales (139 units) and a 37.7% increase in dollar volume, totaling $88.5 million. This marks a strong resurgence in activity and growing buyer demand.

Kootenay Region Stays Strong

With 251 units sold, the Kootenay region posted a 5.0% increase in sales and a 12.1% rise in dollar volume to $146.2 million, continuing its trend of solid performance.

Central Okanagan Leads in Volume

The Central Okanagan remains the powerhouse of the region with 344 sales (up 15.8%) and a 22.9% increase in dollar volume to $293.7 million. This region continues to show strong fundamentals and demand.

North Okanagan Sees Surge in Activity

The North Okanagan posted one of the most dramatic jumps with 121 units sold, up 33.0%, and a 26.1% increase in dollar volume to $79.3 million—indicating growing interest and value in the area.

Mixed Results in Other Regions

-

Shuswap/Revelstoke showed modest gains in sales (70 units, up 9.4%) but a 2.6% drop in dollar volume.

-

South Peace River led percentage growth with 43.5% more sales and a 56.1% rise in dollar volume, though the region remains smaller in overall size.

Property Type Analysis

Single-Family Homes

Single-family homes showed continued strength with:

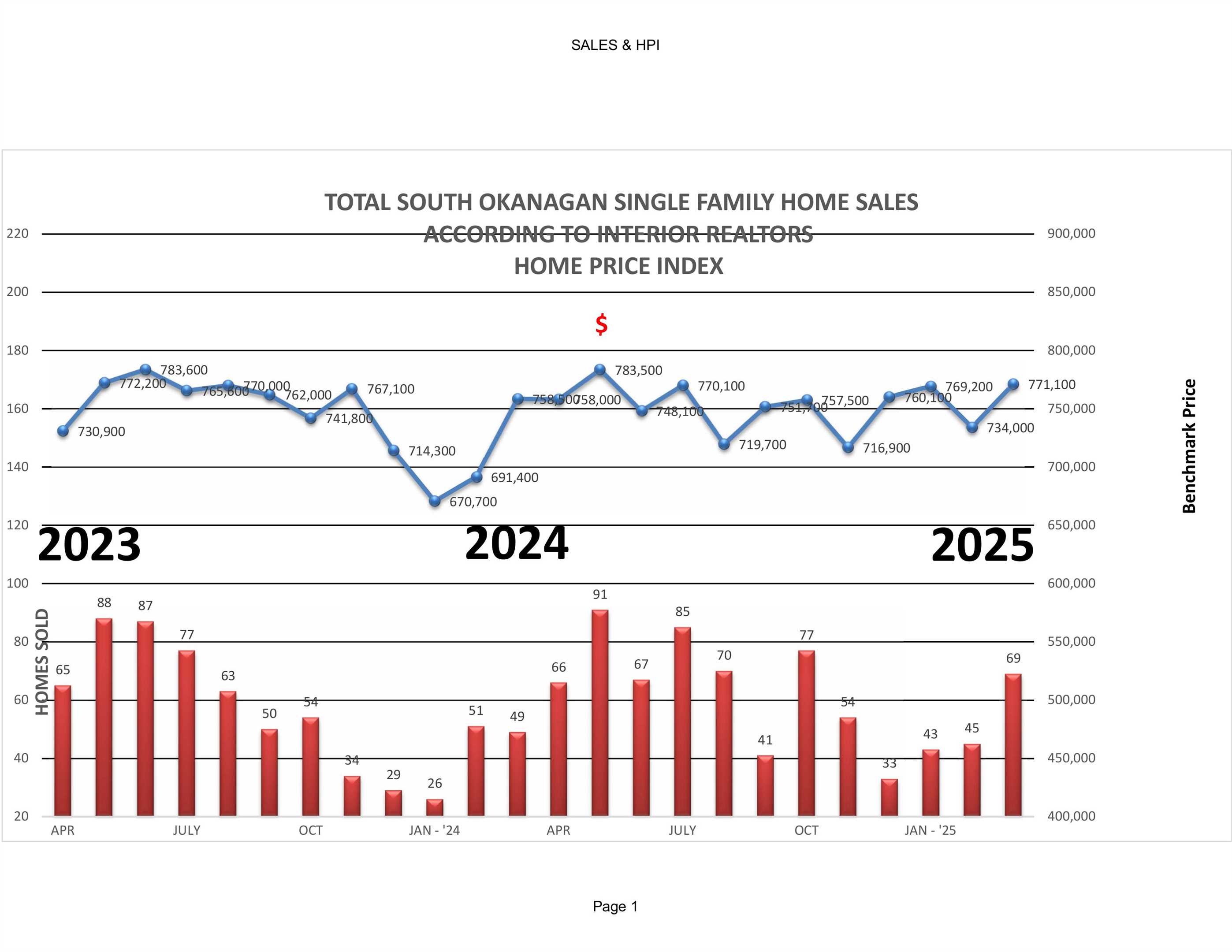

- Benchmark Price (South Okanagan): $771,100 (up 7.2%)

- Sales (South Okanagan): 69 units (up 50.0%)

- Average days to sell at 72 days

- Inventory levels at 511 units (down 5.4%)

Townhouse Market

The townhouse sector demonstrated stability:

- Benchmark price of $529,100 (up 6.4% year-over-year)

- 21 sales (up 50.0%)

- Average days to sell at 84 days

- 141 units in available inventory (down 2.1%)

Condo/Apartment Segment

The condo/apartment market showed modest growth:

- Benchmark price of $420,600 (down 3.6% year-over-year)

- 16.7% decrease in sales

- Average days on market at 56 days

- 320 units in available inventory (up 40.4%)

Market Indicators and Trends

Active listings across the association area increased by 8.3% to 8,374 units, providing more options for buyers. However, new listings increased by 3.0% to 3,214 units, increase in both sales and inventory signals a more active and balanced spring market. While some property types and subregions show cooling or flattening trends (e.g., condos in South Okanagan), the overall landscape remains competitive, especially in the single-family and townhouse sectors.

Looking Forward

With inventory building and buyer interest holding steady, the Interior BC real estate market is primed for a busy spring. Regions like South and North Okanagan offer compelling opportunities for both buyers and sellers, while price growth and active listings suggest continued confidence in the market.

VIP Buyers Get Priority Access

Become a VIP Buyer & Get Priority Access to the Best Properties BEFORE Other Buyers. Call 250-492-1011 or Click Here to get started.